Payments regulatory changes

Problem

There are new 2025 government regulation requirements that Singapore-based businesses must comply with to continue selling. If not met, Shopify merchants won’t be able to receive payouts and eventually can’t accept payments at checkout either. To avoid interruptions to their business, they need to successfully update their business details by set deadlines.

User

This case study will focus solely on existing Singapore merchants already using Shopify Payments; however, the problem was explored as a whole with the addition of how to ensure newly-onboarded merchants were in compliance as well.

Goal

Ensure existing Shopify Payment merchants are successfully updating their business information on Shopify to meet new government regulation requirements (remediation). I was the lead UX designer for this project.

Context

How does regulatory changes affect Shopify and our merchants?

There are 3 new verification types impact Singapore merchants that we need to newly support in our remediation flow:

Verifying the account representative’s identity — all merchants will have to do this. This requires providing proof of identity, address and “liveness'“ (aka verifying a photo of themselves). Using Singpass is the easiest way to satisfy all proof requirements.

Verifying the account representative’s authority — some merchants will have to do this if their current account representative does not hold a position of power that meets the new authority rules. For example, the account representative must be a director or CEO for private companies business type. If not, they must be authorized by a person who holds that position of power (e.g. director or CEO for private companies).

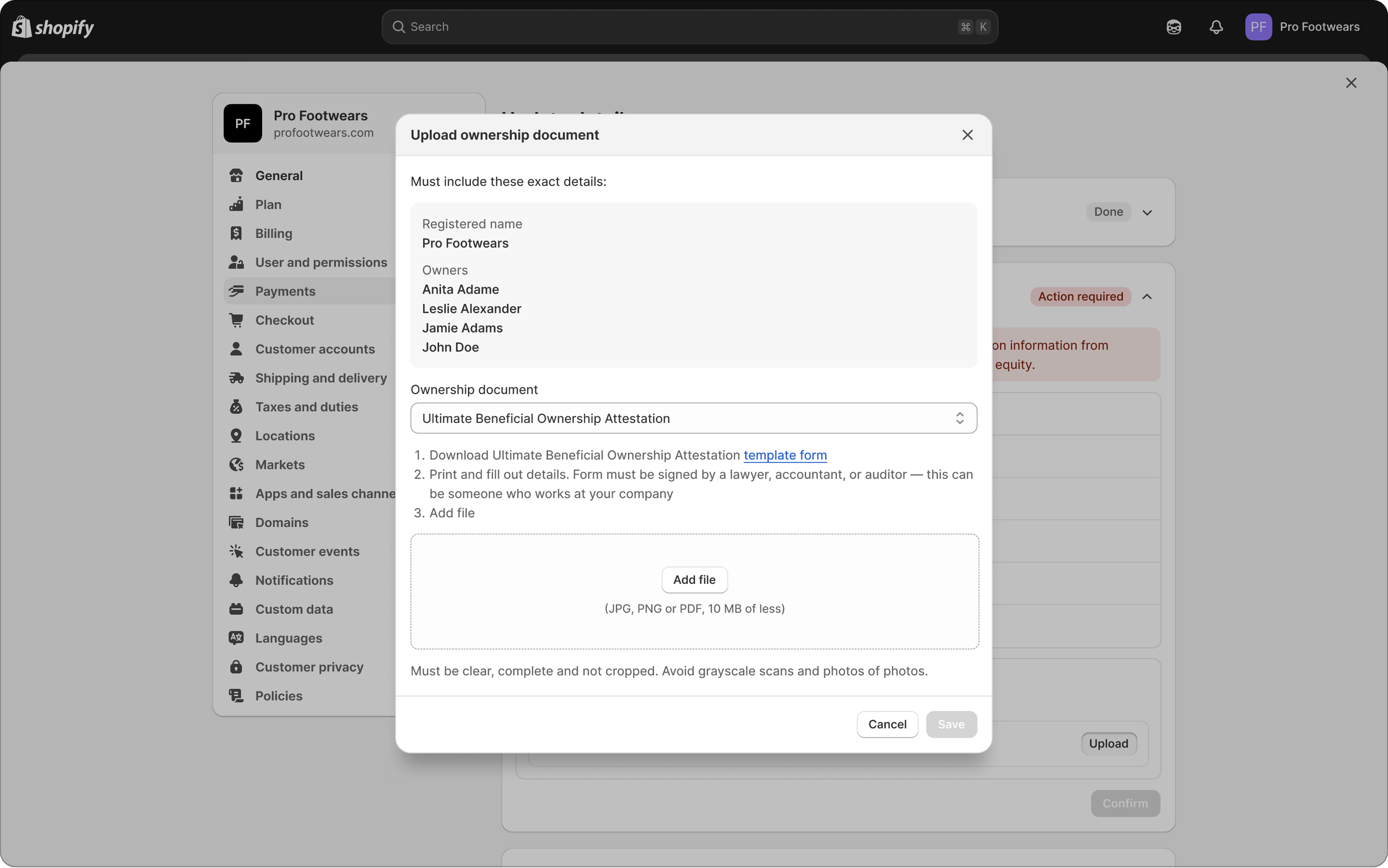

Verifying list of equity owners and board of directors — certain business types like private and public companies, partnerships, and more.

If not met, merchants won’t be able to receive payouts beginning June 24, and won't be able to accept payments beginning July 15. Frustration in understanding what needs to be done and failure to verify their business information successfully despite multiple attempts will break trust between merchants and Shopify.

Existing remediation experience

Doesn’t currently support the new verification types. The business and people details have separate cards. When there is an error on the respective card, it will be default open and have an “Action required” badge. Any changes to the cards that need to be submitted will result in the “Ready to submit” badge. When all changes have been made, the merchant needs to submit details to signal that there are no further updates needed.

Process excerpts

I iterated on how might we gather the proper information from merchants. These ranged from using existing UI patterns vs testing new UI patterns. We also uncovered several gaps with how the current remediation system worked and identified opportunities for us to improve it.

With the tight timelines that we had (e.g. 2 months to gain context, explore, build and test the changes to onboarding and remediation flows), we prioritized quick wins we could ship to deliver a better ux experience immediately and what we descope for post-launch outside of this project.

Process work is at a smaller resolution to protect my work. If you’d like to hear about the project in detail, I’d love for us to chat.