EU VAT changes

Problem

The EU announced new EU VAT rules which involved changes to what VAT rate should be charged and when. They also introduced new remittance options. In order to remain tax compliant, Shopify merchants have to collect VAT at the proper rate by July 1, 2021.

User

Shopify merchants who have fulfillment locations in the EU and ship to other EU countries, and merchants who have fulfillment locations outside of the EU and ship to an EU country.

Goal

Inform and prepare merchants for the EU VAT changes. Ensure we are helping merchants collect VAT at the proper VAT rates that make sense for their business.

Metrics

Before we even did marketing and communication pushes, 30% of shops organically completed the update after discovering the in-admin changes.

Context

How did EU VAT rule changes affect Shopify and our merchants?

Merchants had to be aware of the upcoming EU VAT changes and understand what’s changing. This meant providing adequate awareness and education on the upcoming changes. They needed to let us know whether they were exempted or not from the new rules so that we could collect VAT from their buyers at the proper VAT rate on July 1, 2021 and afterwards. These were the major changes:

Merchants had to collect at the proper destination VAT rate per country depending on how much GMV they earned across the EU

Merchants had the opportunity to use the new One-Stop Shop (OSS) registration to remit across all EU countries. If not, they would need VAT registrations per country. Merchants from a non-EU country into an EU country could also register for a Import One-Stop Shop (IOSS) registration.

Merchants making less than €10 000 EUR in sales to other EU countries are exempted and don’t need to collect at the destination VAT rates.

We had 3 months to design, build, debug, and launch 2 experiences:

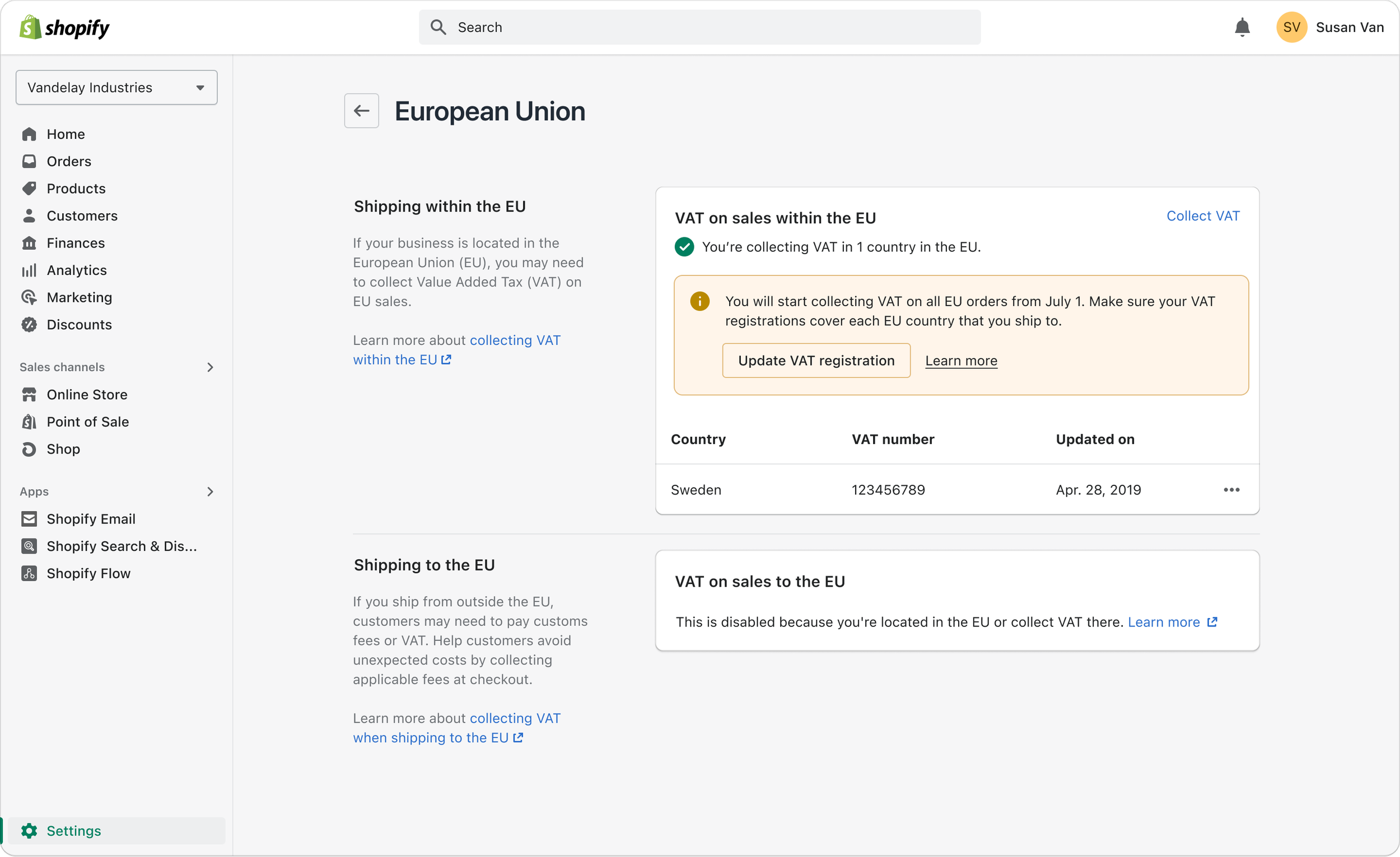

The admin changes leading up to July 1 focused on informing merchants of upcoming changes and asking them to confirm their registration type

The admin changes after July 1 were based on the new EU VAT rules (e.g. introducing new registration types and collecting at the proper VAT rate)

I was the lead UX designer on this project.

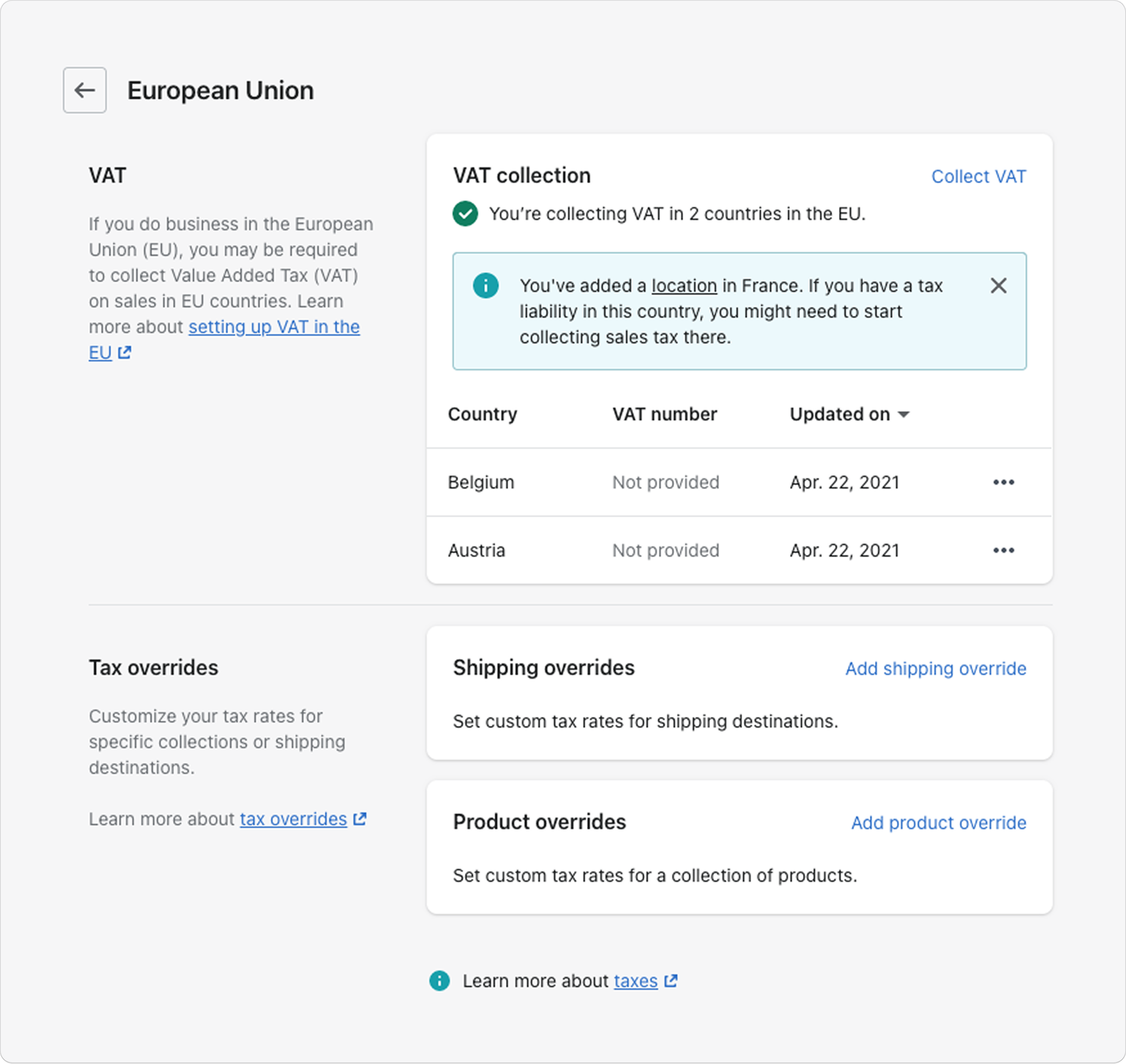

Existing EU tax settings page

The existing experience required merchants to enter VAT numbers per EU country because the current government system required merchants to register for a separate VAT number per EU country.

Process excerpts

Some of my process images have been blurred to protect information.

I used data, research, and journey mapping to understand how our merchants would be affected. From data, I learned that we needed to emphasize the “micro-business” option as a vast majority of our merchants would fall under this category based on the GMV that we gathered on our platform. This helped to inform design decisions. However, merchants could still have revenue generated from other platforms, so we still need merchants to confirm what their status is.

From the research, I applied content modelling and object-oriented UX to illustrate the new mental model structure we needed to support and design with a content-first approach. We should orient the language to be around confirming VAT registration types rather than confirming VAT rates because merchants may not know what VAT rates they need to collect. However, they will know whether or not they have a registration in a country because this is a process they would have done outside of Shopify with their respective governments in the past.

Some stakeholders still strongly felt we should be positioning the language on confirming VAT rates rather than VAT registrations. Using flow charts and low-fi wireframes, I persuaded stakeholders to see why my recommended direction (e.g. VAT registrations) would be the right approach based on the downstream effects that each direction could impact workflows. With the tight timelines, I achieved early alignment before investing in high-fidelity mocks.