Duties & import taxes

Problem

Merchants face barriers to meaningfully scale. From a 2021 Shopify merchant survey, duties calculation is one of those key barriers due to its complexity and impact to buyers and tax compliance. Orders that don’t have duties and import taxes paid in advance have longer delivery times due to lengthier broker processes. Buyers are also hit with surprised fees on delivery, having reduced trust in the merchant for not communicating these costs upfront.

User

~5,300 Shopify merchants currently using offering some type of duties solution on their online store, either using a third-party solution or baking duties and taxes cost into the product price. ~350,000 merchants currently communicating about potential duties on their online store but not collecting.

Goal

Build a 0-to-1 product that allows merchants to collect duties and import taxes at checkout and provide a premium shipping experience to their buyers. I was the lead UX designer for several milestones in this product.

Metrics

In 2022, there were more than 1K monthly active merchants using our product. We had shown duties calculations in over 4M checkouts and zero duties charge in over 3M checkouts with $35.6M in GMV that year.

Context

How do duties and import taxes affect Shopify and our merchants?

Merchants want to bring a great buying experience to new markets in order to increase revenue, boost brand equity and diversify risk by not limiting sales to just one market. However, orders with unpaid duties and import taxes often result in longer delivery times and surprised hidden fees for the buyer. Due to pain points of shipping, merchants with cross border sales often face buyer complaints, parcel refusals, chargebacks, and negative reviews. There’s also a tax liability risk for merchants who don’t understand the complexities of international taxes well enough to remain compliant as their cross border business grows.

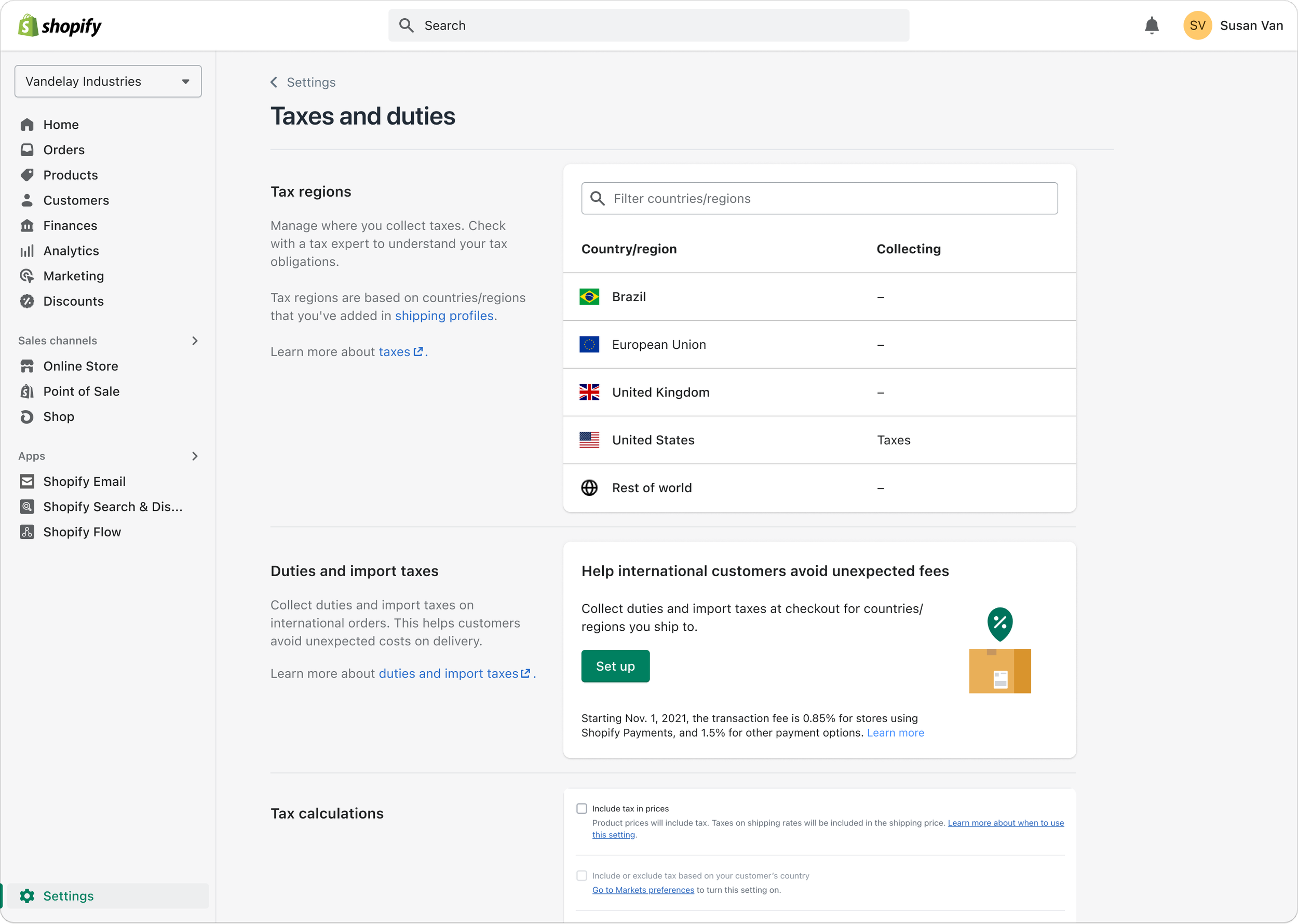

Because duties and import taxes was a net-new concept in admin, there were multiple touch points that I had to design changes for and align with 6 stakeholder teams (taxes, checkout, orders, shipping, billing and analytics team within Shopify):

Taxes settings

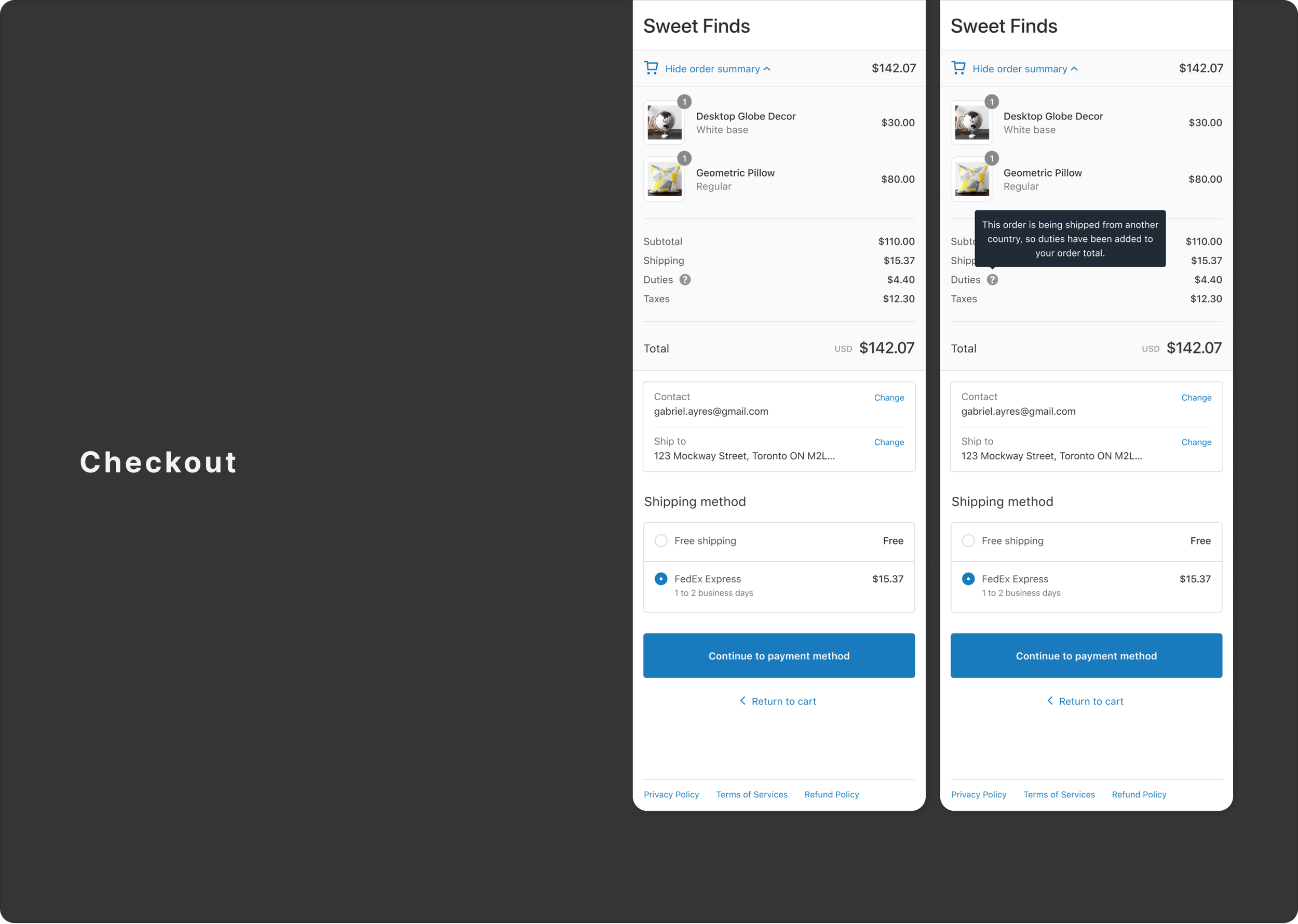

Checkout

Customer notification templates

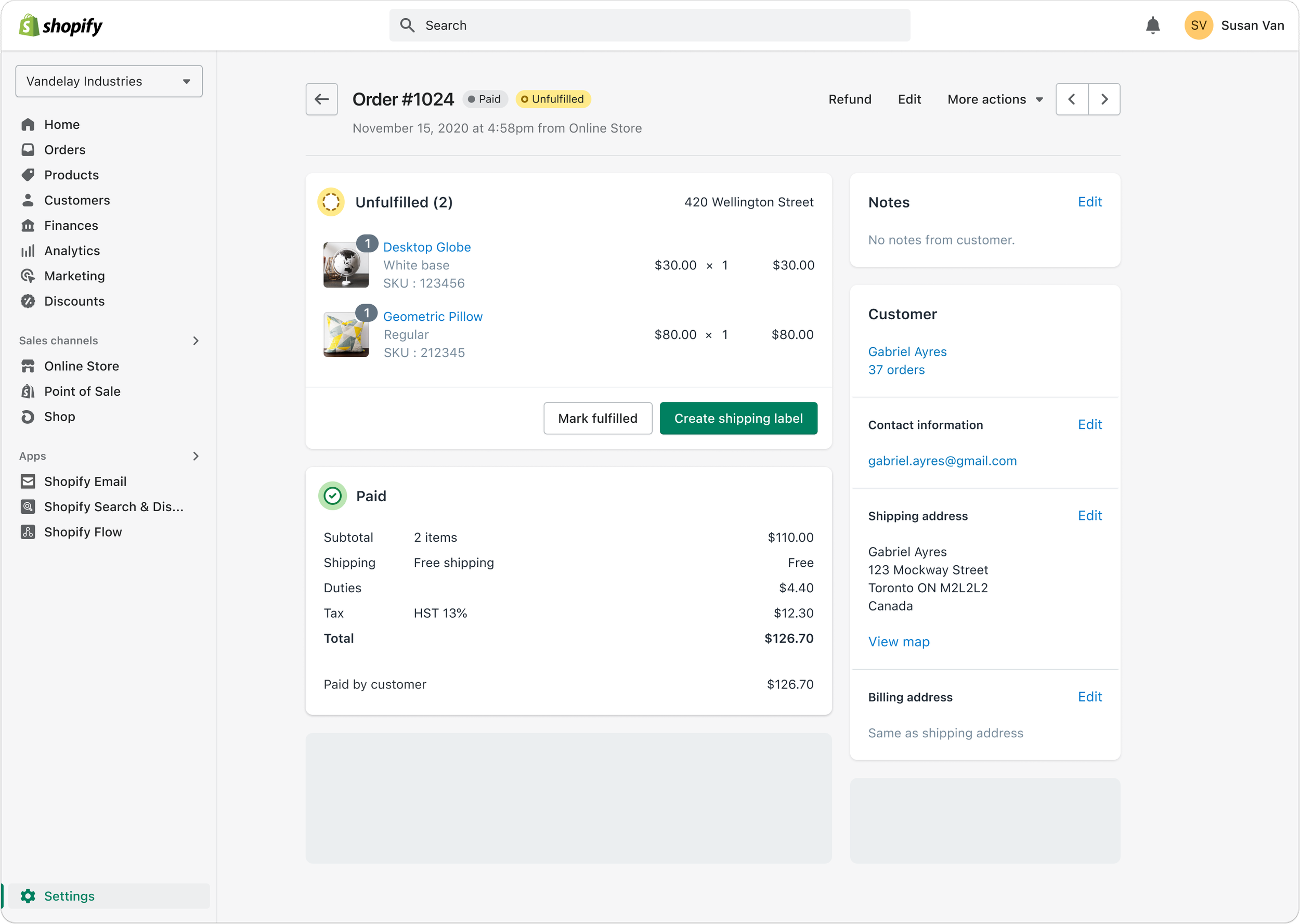

Orders

Shipping labels

Refunds

Billing invoices

Analytics

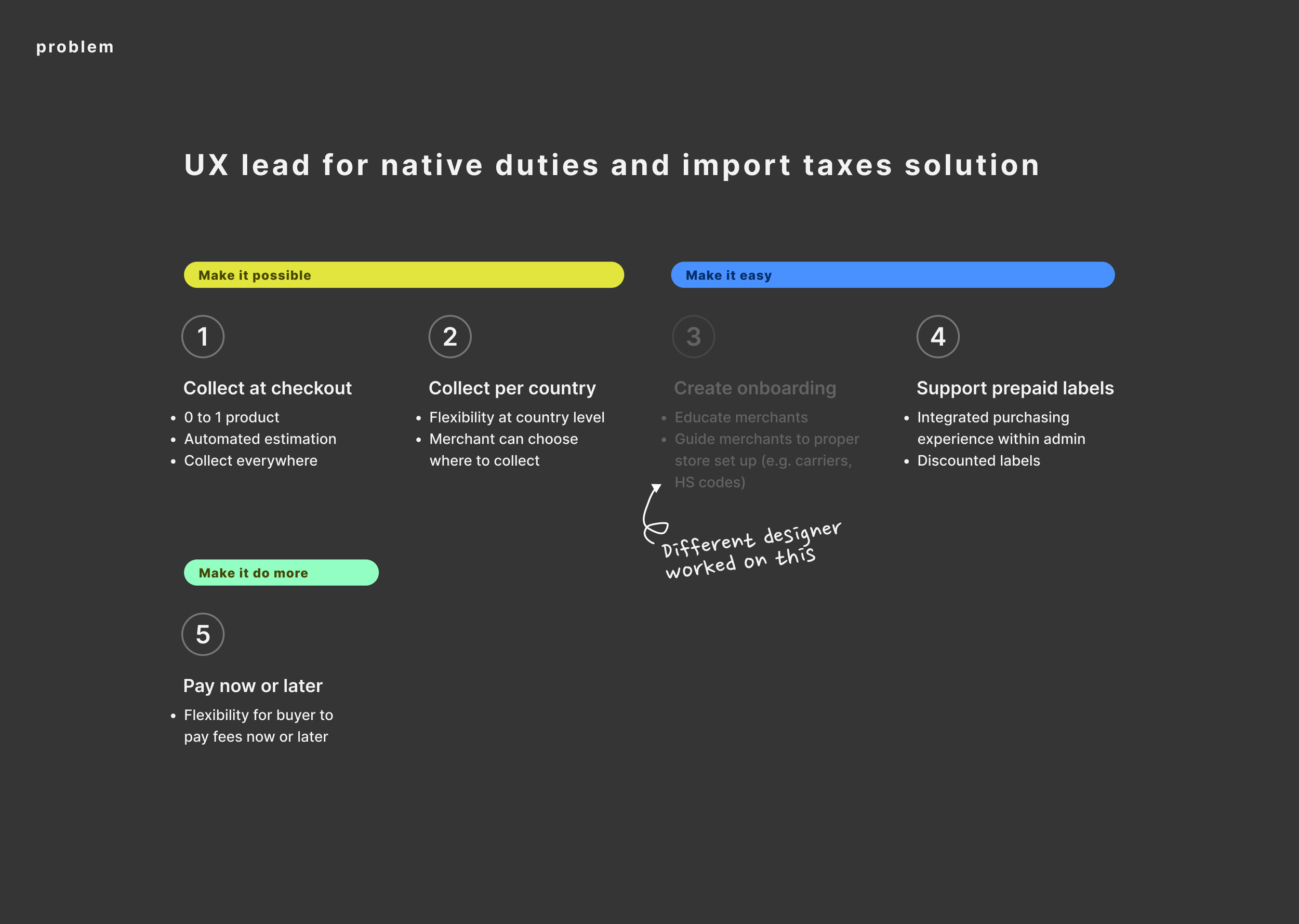

I was the UX lead for several milestones when growing this product from 0-to-1. Here are the stages of growth that I was responsible for:

Process excerpts

I worked with a user researcher to conduct extensive market and user research on merchants and buyers’ current experiences. This was to gain an understanding of their pain points and familiarity with duties and import taxes. Research was also important for product naming because there are so many similar industry terms (e.g. import fees, duty, duties, international taxes, cross border taxes). We wanted to make sure we were using the most familiar term that is also distinguishable from domestic taxes. I did research, iterations and usability testing for each milestone that we hit.

Process work is at a smaller resolution to protect my work. If you’d like to hear about the projects in detail, I’d love for us to chat.